.jpeg)

A PHD THESIS AT BASRA UNIVERSITY (THE IMPACT OF BANKING MERGER ON THE EFFECTIVENESS OF FINANCIAL MARKETS IN SELECTED ARAB COUNTRIES THE REFRENCE TO IRAQ)

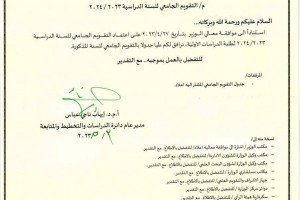

A PHD thesis was examined at the College of Administration and Economics at the University of Basra (The impact of banking merger on the effectiveness of financial markets in selected Arab countries with a reference to Iraq).

The thesis presented by the researcher ((Jabbar Abdul Hussein Hammoud Al-Aboudi)) included four chapters. The first chapter dealt with the methodology of the study and a review of previous studies. The second chapter was devoted to the theoretical framework of the study, while the third chapter came to clarify the practical framework of the study, and the fourth chapter was concerned with conclusions and recommendations.

The thesis aimed to identify the reality of Arab banks, the research sample before and after the merger, and its reflection on increasing its effectiveness, and to assess the experience of banking integration in Arab countries using financial and banking indicators through the evaluation of the merged banks, the research sample.

The researcher concluded from the results of the analysis of merger indicators of Abu Dhabi Central Bank, the gradual rise of the indicators (market value, growth rate of earnings per share and net working capital) after the merger, but their levels were lower compared to these indicators before the merger, with the exception of the earnings per share index, which recorded higher levels compared to before Merger.

The researcher recommended the necessity to expand in the future in the study and analysis of merger indicators for First Abu Dhabi Bank should be expanded to give a sufficient picture to show the success of the merger deal between banks and its positive reflection on the bank’s performance indicators after the merger in addition to the necessity that the merger deal not to be through ownership or monetary merger, as it may not constitutes a financial feasibility in contrast to a merger through shares, which shows financial viability.

.jpeg)